vermont state tax return

Return and payment of withheld taxes 5843. Prepare and e-File Vermont Tax Return.

Tax Prep Tax Preparation Income Tax Preparation

IN-111 Vermont Income Tax Return.

. W-4VT Employees Withholding Allowance Certificate. TaxFormFinder provides printable PDF copies of 52 current Vermont income tax forms. Click on Check the Status of Your Return Personal Income Tax Return Status.

FY2022 Property Tax Rates. VT Department of Taxes PO Box 1881 Montpelier VT 05601-1881 If you owe money to state include a check payable to VT Department of Taxesand send the check or money order along with the other tax forms. 15 Tax Calculators 15 Tax Calculators.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Individual Income Tax 20. Vermont State Income Tax Return forms for Tax Year 2021 Jan.

Direct Deposit is not available for Vermont. That link will take you to form that requires your ID number last name zip code and the exact amount of your refund. If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penalty.

Electronic filing allows us to quickly and more accurately process your refund. PA-1 Special Power of Attorney. The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax.

Eligibility and administration. This is because the software does the math for you and may catch errors such as omitting a Social Security Number or a signature which can slow processing time. DATEucator - Your 2022 Tax Refund Date.

The State of Vermont requires the collection of Purchase and Use Tax at the time of vehicle registration learn more about vehicle taxation. File or Pay Online. If you are receiving a refund or have no taxes due send your tax return.

Vermont Fish and Wildlife. Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes. Vermont State Parks Explore our state parks and immerse yourself in the beauty of Vermont.

There is no evidence that e-filing contributes to identity theft. W-4VT Employees Withholding Allowance Certificate. Maintenance of trust account.

You are required to select the type of ownership of your vehicle at the time you register in Vermont learn about the. To mail your return with a payment send it to Vermont Department of Taxes PO. E-filing is also a secure way to file.

VT Department of Taxes PO Box 1779 Montpelier VT 05601-1779. Call 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-statefor information on the status of your return and refund. Box 1779 Montpelier Vermont 05601-1779.

Vermont State Parks Explore our state parks and immerse yourself in the beauty of Vermont. State government websites often end in gov or mil. Pay Taxes Online File and pay individual and business taxes online.

Vermont tax forms are sourced from the Vermont income tax forms page and are updated on a yearly basis. IN-111 Vermont Income Tax Return. E-Filing non-resident VT state returns is not available.

Visit Vermonts Refund Status page and click on Check the Status of Your Return You will find it toward the bottom left. Check For the Latest Updates and Resources Throughout The Tax Season. Non-resident VT state returns are available upon request.

Understand and comply with their state tax obligations. Prepare and e-File Your 2021 Vermont State Tax Return with Your Federal Tax Return. Allow up to 8 weeks for processing time.

Vermont School District Codes. A Purchase and Use Tax Computation - Leased Vehicle Form form VD-147 may be submitted in. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets.

The process time for e. File state taxes for free Get Started with Credit Karma Tax. Then click Search to find your refund.

Box 1881 Montpelier Vermont 05601-1881. Before sharing sensitive information make sure youre on a state government site. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date.

Vermont School District Codes. File My Federal Vermont State Returns. If the individual purchases this vehicle at the end of the lease they will pay tax on the residuallease end value of the vehicle.

Checks can be cashed up to 180 days after the issue date. 2022 Vermont State Tax Return. Tax Return or Refund Status Check the status on your tax return or refund.

Forms E-file Information General Tax Return Information Filing Status Information Residency Information Military Business Mailing Addresses Business Mailing Addresses Federal Links. Preparation of a state tax return for Vermont is available for 2995. Vermont State Tax Refund Status Information.

If you are due a refund or dont owe any tax mail your return to Vermont Department of Taxes PO. You must file and pay electronically if. All taxpayers may file returns and pay tax due for Withholding Tax using myVTax our free secure online filing site.

The 2022 state personal income tax brackets are updated from the Vermont and Tax Foundation data. Filing online through the Vermont Department of Taxes new online system myVTax has been mandated by the Commissioner of Taxes beginning with the tax year ending Dec. Vermont State Parks Explore our state parks and immerse yourself in the beauty of Vermont.

Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. The Vermont Department of Taxation may withhold some. However if you owe Taxes and dont pay on time you.

The registration application is received from a Vermont Dealer or a Vermont Dealer acting on behalf of the Lessor. To check the status of your return you should wait at least 72 hours for an electronically filed return and four or more weeks for paper filings. Sign Up for myVTax.

Vermont State House 115 State Street Montpelier VT 05633-5301 802 828-2228. PA-1 Special Power of Attorney. Learn about the regulations for paying taxes and titling motor vehicles.

Ad See How Long It Could Take Your 2021 State Tax Refund. 2021 Tax Year Return Calculator in 2022. E-File is not available for Vermont.

VERMONT DOWNTOWN AND VILLAGE CENTER TAX CREDIT PROGRAM 5930aa. Tax Return or Refund Status Check the status on your tax return or. Wheres My State Tax Refund Vermont.

Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter Rebate Claim and Estimated Payments. Vermont Fish and Wildlife Find information apply for licenses and permits and learn about conservation. For returns filed by paper.

Tax Prep Tax Preparation Income Tax Preparation

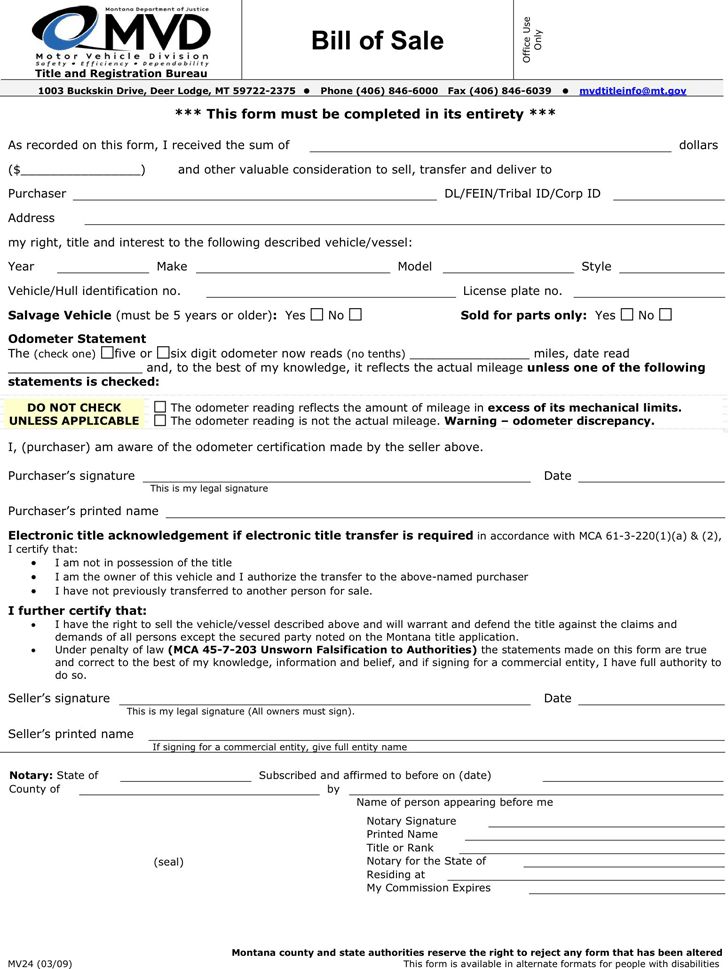

Pin On Legal Form Template Waiver Download

Cavendish Proctorsville Town Of Cavendish Town Of Cavendish Vermont Usa Cavendish Vt 1869 Map Of Cavendish Cavendish Map Vermont

Table 2 Federal And State Individual Income Tax Bill For Taking The Cash Option On The Diy Network Ultimate Retreat In Burlington Income Tax Diy Network Income

Vermont Could Lose 430 Million In Revenue Next Fiscal Year Economist Says

The Best And Worst U S States For Retirement Best Places To Retire Retirement Retirement Community

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Notary Public Vermont Tote Bag Zazzle Com Texas Tote Bag Notary Public Tote Bag

Pin On Legal Form Template Waiver Download

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage